44+ how much should mortgage be based on income

Web When all things are considered like your debt down payment and mortgage rate you might find you could borrow as much as 6 or 7 times your salary for a. Ad Need To Know How Much You Can Afford.

This Chart Shows How Much Money You Should Spend On A Home Mortgage Help Best Mortgage Lenders Interest Only Mortgage

Web Want a quick way to determine how much house you can afford on a 40000 household income.

. Well Help You Estimate Your Monthly Payment. Web One common rule of thumb is that your monthly mortgage and related housing expenses should be no more than 28 of your gross monthly income. Web The 2836 is based on two calculations.

Web This means that if you want to keep your DTI ratio at 43 you should spend no more than 18 900 of your gross income on your monthly payment. Get Your Quote Today. Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac.

Use our mortgage income calculator to examine. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Well Help You Estimate Your Monthly Payment.

2 To calculate your maximum monthly debt based on this ratio multiply your. Find Out If You Qualify For a Low Rate in Minutes. Lock In Your Low Rate Today.

Lets say your total. Account for interest rates and break down payments in an easy to use amortization schedule. Web Use our free mortgage calculator to estimate your monthly mortgage payments.

A front-end and back-end ratio. Using this as a guideline if. Estimate your monthly mortgage payment.

Ad See how much house you can afford. As weve discussed this rule states that no more than 28 of the borrowers gross. Trusted VA Home Loan Lender of 300000 Military Homebuyers.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. VA Loan Expertise and Personal Service. Ad Need To Know How Much You Can Afford.

Ad Highest Satisfaction for Mortgage Origination. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Ad Calculate and See How Much You Can Afford.

Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. 43 043 x 5000 2150 Max debt payments. Web The rule of thumb is that you can afford a mortgage where your monthly housing costs are no more than 32 of your gross household income and where your total debt load.

Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Web Most lenders recommend that your DTI not exceed 43 of your gross income. Web What percentage of income do I need for a mortgage.

Apply Now To Enjoy Great Service. Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income and your total monthly debt including your anticipated monthly mortgage payment and other. Get an estimated home price and monthly mortgage.

Web This model states your total monthly debt should be 25 or less of your post-tax income. To calculate how much you can afford with the. However how much you.

Web Generally speaking most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a-half times their annual gross. Web To calculate this multiply your monthly income by 28 or 36 and then divide it by 100. Web Lenders usually dont want you to spend more than 31 to 36 of your monthly income on principal interest property taxes and insurance.

Lets say you earn 5000 after taxes. A conservative approach is the 28 rule which suggests you shouldnt spend more than 28 of your gross monthly income. Web Mortgage affordability calculator Find out how much house you can afford with our mortgage affordability calculator.

For example with a 4500 monthly income you should spend no more than. Compare Home Financing Options Online Get Quotes. Contact a Loan Specialist.

Web As a rule of thumb most homebuyers can afford a mortgage that works out at between two and two and a half times their total income. Compare Home Financing Options Online Get Quotes. 1000 Max home expenses.

Web How much mortgage can you afford. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

If You Re Buying A 500k Home Ten Percent Down What Is The Right Annual Income For Supporting That Purchase What Factors Went Into That Quora

Will I Be Comfortable With A 550k House With A Salary Of 68k R Realestate

First Community Mortgage Home Facebook

How Much House Can I Afford Insider Tips And Home Affordability Calculator

Subprime Mortgage What Are The Risks Invlolved In Subprime Mortgage

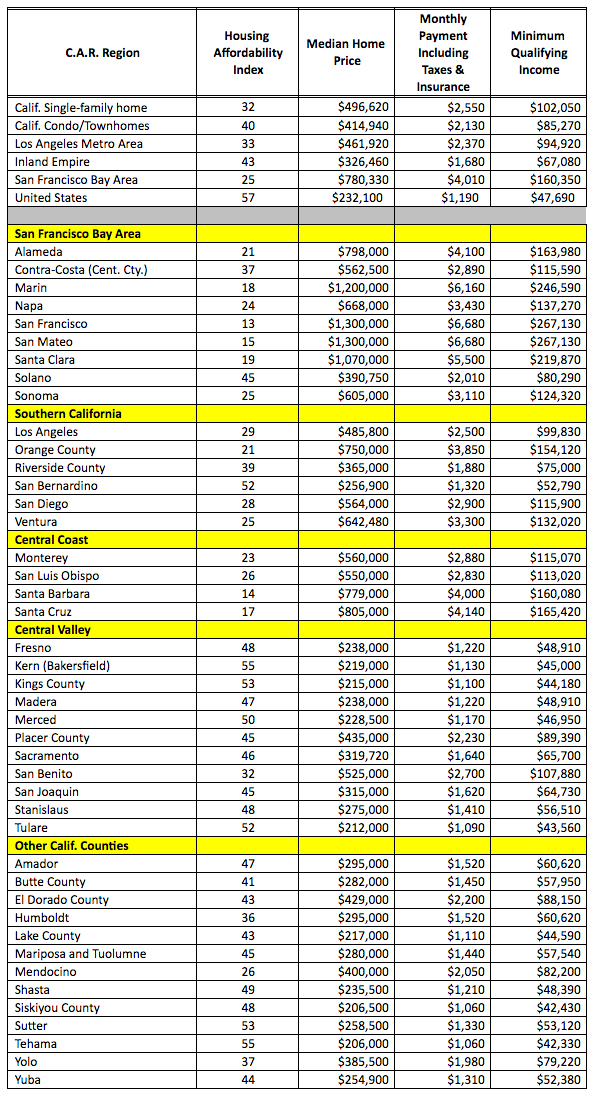

Need A Mortgage In California Realtors Say You Better Earn This Much Money Housingwire

Mortgage Broker Taree Forster Tuncurry Better Loan Rates Mortgage Choice

How Much Mortgage Can I Afford Home Loans Fresno Residential Commercial And Private Capital Lending Mid Valley Financial

What Percentage Of Income Should Go To Mortgage Morty

44 Financial Advisor Landing Page Templates By Templatemonster

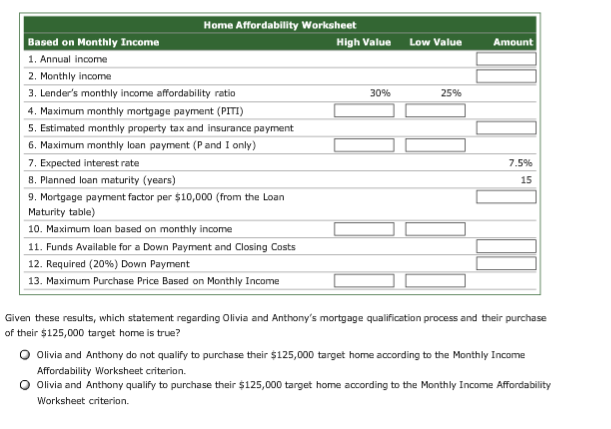

Solved Home Affordability Worksheet Based On Monthly Income Chegg Com

First Community Mortgage Avaleht Facebook

How Much Of My Income Should Go Towards A Mortgage Payment

Debt To Income Ratio Formula Calculator Excel Template

Isle Of Man Portfolio Jan 22 By Keith Uren Issuu

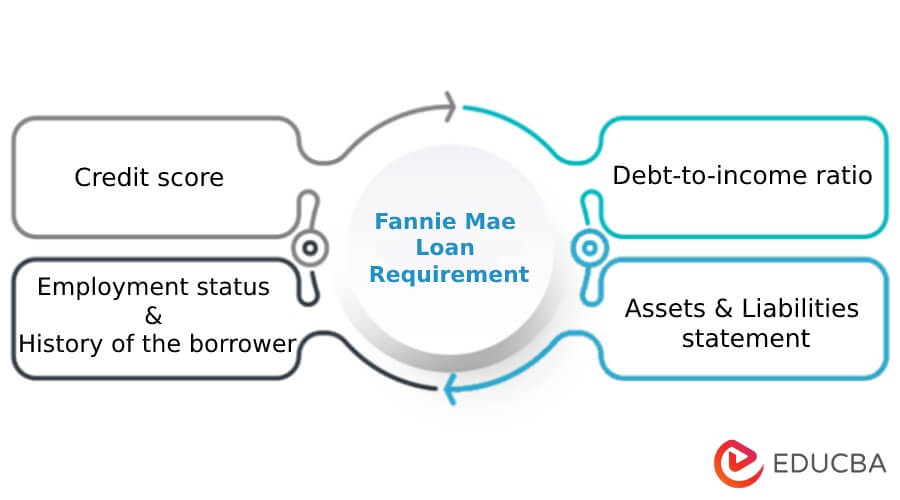

What Is Fannie Mae Purpose Eligibility Limits Programs

8712 Lakeview Hls Millstadt Il 62260 Mls 22067825 Trulia